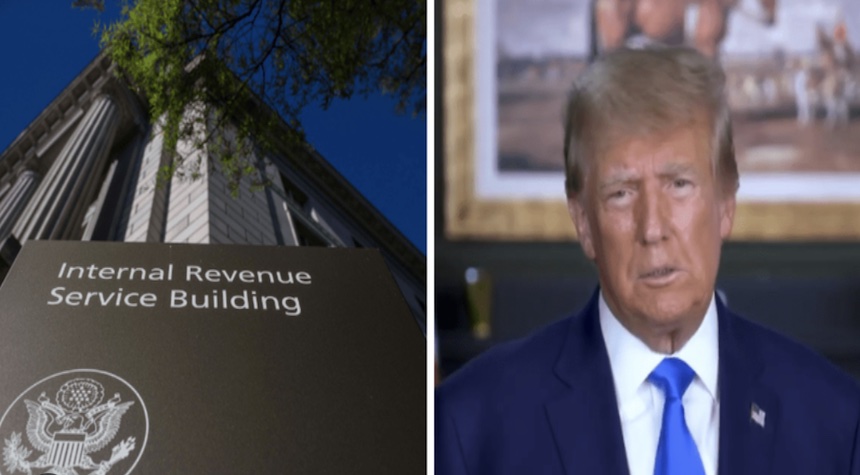

The Justice Department has announced that an IRS contractor had pleaded guilty to stealing and leaking sensitive tax information to the media. The announcement comes weeks after the person was charged with the crime.

The documents that he is accused of leaking are associated with America’s richest people, including former President Donald Trump.

Charles Littlejohn, 38, an IRS contractor from Washington, D.C., has pleaded guilty to revealing tax return information in the public domain without authorization.

Charles Littlejohn, by using his position as a contractor for the government to access private tax information and steal it, then disclose that information publicly, violated federal law and betrayed public trust, said Attorney General Merrick Garland. The Department of Justice will follow the facts to their conclusion and hold those responsible who violate laws accountable.

The unauthorized theft or disclosure of tax returns by government employees and contractors is a serious violation of public trust, said Nicole M. Argentieri, Acting Assistant Attorney-General of the Criminal Division of the Justice Department. “The Department will hold those accountable who illegally abuse their access to sensitive information.”

The Justice Department released a press release that outlined Littlejohn’s actions in detail. He obtained and revealed tax returns for thousands of people. The consultant exploited wide search parameters and subverted IRS protocol between 2018 and 2020 to obtain sensitive information.

A news outlet published in September 2020 a series of articles that revealed the financial details of “Public Official A”, which were derived from stolen documents. This revealed a vulnerability in the security system of the agency. The IRS’s failure to protect private information was shocking.

In a press release, Trevor Nelson, Deputy Inspector-General for Investigations at the IRS said that “the American people have a right to expect integrity from anyone who has access to taxpayer information as a result of their employment.”

Republicans accused Democrats of weaponizing the IRS against conservatives when the first breach was revealed. There are good reasons to suspect skulduggery, given the agency’s history.

Ken Griffin, a well-known hedge fund manager, was also caught in Littlejohn’s web along with many other private individuals. Griffin filed a suit against the IRS later for failing to safeguard his sensitive records. Over 50 articles were published by different news outlets about the information Littlejohn revealed in November 2020.

Danny Werfel, the IRS commissioner, assured the public the agency was implementing new protections and protocols to better safeguard the privacy of individuals. The White House’s silence has only fueled suspicions and questions about a possible repeat.

The defendant will be sentenced on January 29, 2024. His motive has yet to be established. Maybe he was motivated by a political motive, or perhaps he wanted something else from it. This incident has dealt a severe blow to both the credibility of the IRS and the Biden administration.