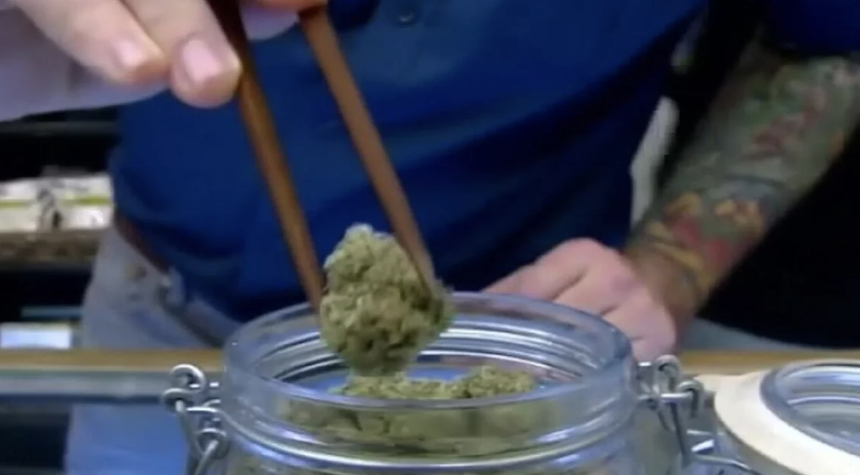

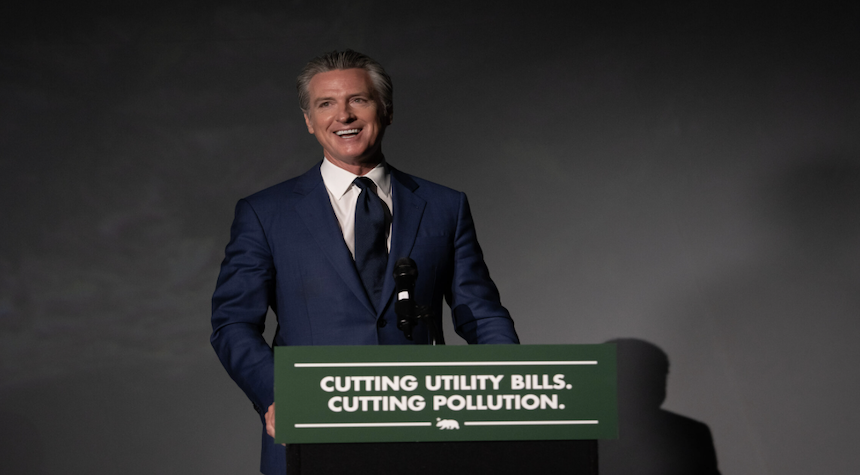

California Gov. Gavin Newsom signed a bill on Monday that decreases the tax burden on the state’s cannabis industry. This move has been interpreted by some as an effort to provide relief to the legalized market.

Officially known as AB 564, the legislation not only overturns the previously instated 25% excise tax increase on the cannabis industry but also fixes the state’s cannabis excise tax rate at 15% through the year 2028, according to an announcement from the governor’s office.

We should note that the governor’s statement emphasized the goal of this action: facilitating the growth of the legal market, ensuring the availability of safe products for consumers, and directing benefits towards local communities. “We’re rolling back this cannabis tax hike so the legal market can continue to grow, consumers can access safe products, and our local communities see the benefits,” Newsom said.

In addition to the tax amendment, the administration has amplified its enforcement actions against unlawful operators in the state’s cannabis industry. The Unified Cannabis Enforcement Taskforce reportedly seized and destroyed an estimated $890 million worth of illegal cannabis, equivalent to 317 tons or 635,303 pounds.

Assemblymember Matt Haney, who sponsored the bill, indicated that the new legislation “helps level the playing field” and provides the legal cannabis industry with a fair opportunity to compete against the untaxed and unregulated illegal markets. “It protects California jobs, keeps small businesses open, and ensures that our legal cannabis market can grow and thrive the way voters intended,” Haney stated.

This measure is anticipated to become effective in October, even though the tax increase was implemented last month.

Reports indicate that the bill has been well-received by some industry experts. Brian Camire, chief legal counsel of Weedmaps, said, “This rollback of a 25% hike in existing taxes will bring greater stability to a faltering market and disincentivize bad actors that undermine legitimate players.”

In conclusion, this legislation is set to freeze the tax increase for five years, potentially stabilizing the industry in the near future.